Our strategy

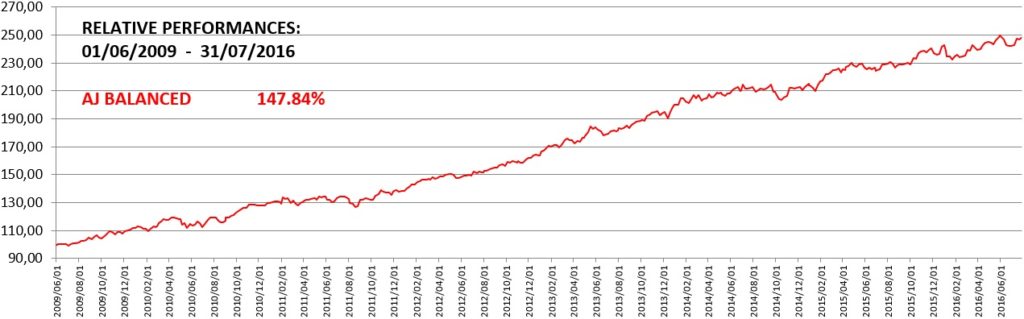

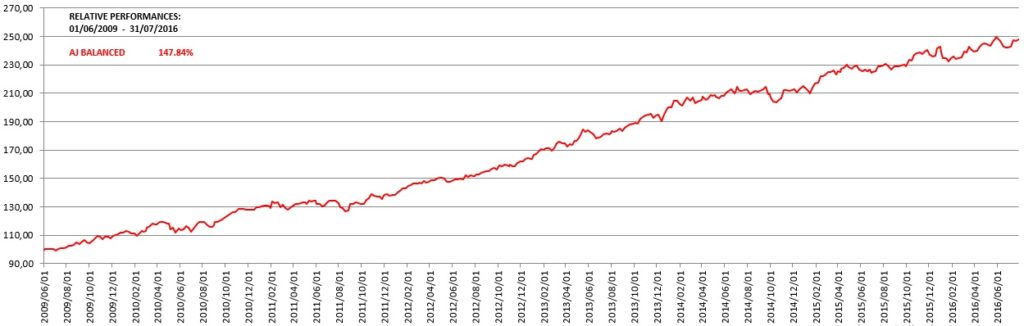

We are positive trend investors focused on four asset classes i.e. money markets, bonds, listed property and equities with the goal of positive returns over 12 months to 18 months . Our core belief is that being in the right asset classes at the right times is the most important determinant of investment performance. Click here for research results in support of this belief.

Anton Van Niekerk

Investment Manager

What we offer

The skill and ability to move in and out of asset classes

In a landmark paper, published in 1986, Determinants of Portfolio Performance, Brinson, Hood and Beebower concluded that asset allocation is the primary determinant of a portfolio’s performance and accounts for some 90% of the return experienced. Ibboston and Kaplan later confirmed this in 2000 with a finding of 75%.

Source: Financial Analyst Journal, 1986 and 2000